Income Protection for Working Women

Harriet Tubman broke countless barriers in her awe-inspiring life. Margaret Hamilton’s software wizardry played a key role in landing astronauts on the moon.

These incredible people laid the foundation for many women, now and in the future, who will continue to rewrite history.

The participation of women in the workforce has grown from 29% in 19451 to nearly 47% today.2

Times have changed because of the trailblazers who fought for progress and because of all of those who continue to fight for equality. Unfortunately, women are still underserved when it comes to income protection insurance.

Income is a valuable asset, and women deserve to know more about protecting it.

How women are underserved with DI

Short and long-term disabilities create financial risks for women-led households. Having disability income insurance (DI), also known as income protection, is like having a backup plan for hard work – and for financial responsibilities that don't go away through sickness or injury.

If a disability due to illness or injury prevents a working woman from doing her job and earning a paycheck, DI can provide a monthly benefit to help pay for:

Mortgage

Groceries

Utilities

Car payments

Credit card bills

Childcare

There are

32 million

unmarried female workers in the U.S.3

That’s 25%of

the U.S. workforce, and

over half

of these women have no DI at all.3

On top of that, nearly 1 in 3 single female workers say they're "extremely unprepared" for any period of disability if they should lose their income.3

What do these numbers mean? More women deserve to take part in income protection conversations and have confidence in the options to safeguard their paychecks.

Paycheck protection for working women on the move

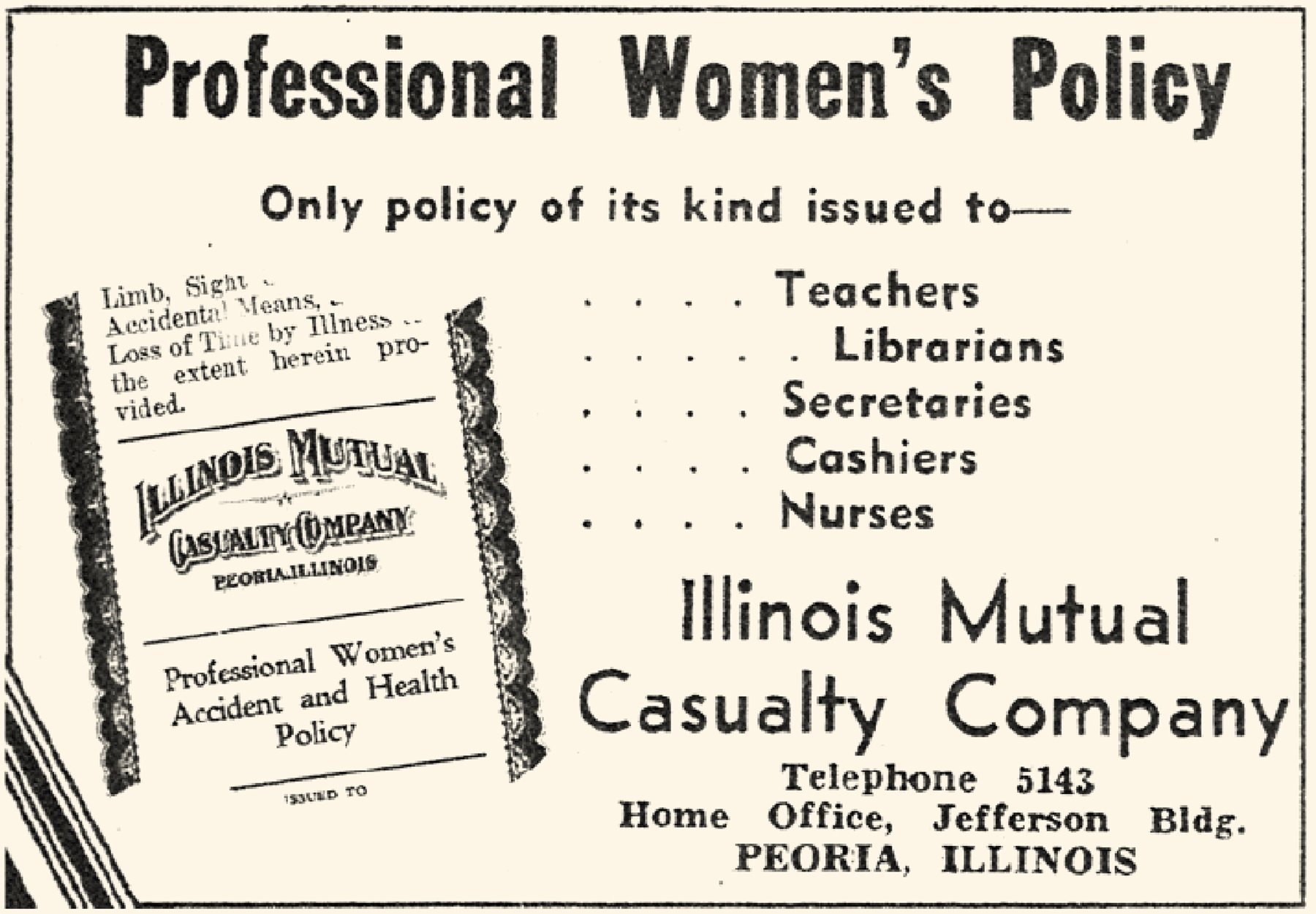

From our early roots to today, Illinois Mutual has aimed to serve women. In 1934, we were the first company to issue a professional policy designed for working women.

Illinois Mutual has specialized DI expertise in the occupations and income protection needs of women who work as:

Nurses

Dental hygienists

Hair stylists

Real estate agents

Skilled laborers (construction, welders, electricians)

Small business owners

Stay-at-home moms

Teachers

Truck drivers

And hundreds more!

DI pays a portion of monthly income - and offers a chance to focus on recovery - if a disability takes away the physical ability to perform essential job duties.

BE for women who own small businesses

Up until 1988, some U.S. states required women to have male relatives cosign on business loans. Thankfully, legislation changed this outdated and unnecessary practice.

Small business owners spend a lot of time working. Their business is like a home away from home, and their employees are like family. They rely on the owner to keep the business running and financially healthy.

That’s why every small business owner should know about another form of income protection: business expense (BE) insurance.

BE, also called business overhead expense, could help keep a business going if an illness or injury disrupts an owner's paycheck and prevents them from working.

The benefit from BE can cover a wide range of fixed business expenses, including:

Employee salaries except salary of the insured, someone who replaces the insured, and any family member working less than 3 months for the insured

Office maintenance and repairs

Lease or rent payments

Property and payroll taxes